Fast funding

Get approved in 1-2 business days. Receive funding 2-3 business days later

Shorter lines

Pay automatically through your processing. Pay more when your sales are strong; less if sales slow down

No credit impact

No personal impact

Quick and convenient

Based on your recent processing history, we will determine the funds you may be eligible to receive in Clover Capital funding. Applying does not affect your credit score.

How to qualify

Your business must be at least 6 months old with a minimum processing volume of $1,000/month for 3 months. Additional qualifications apply. Terms and Conditions apply.

Flexible terms

A percent of your daily sales is automatically set aside to pay for your cash advance with flexibility. Applying for more capital is even easier once you establish history.

Increase Inventory

Restock popular items to meet your growing demand.

Upgrade equipment

Get the hardware and equipment you need to streamline your space and operations.

Hire more employees

Staff up and invest in the people who’ll help take your venture to the next level.

Amplify your marketing

Staff up and invest in the people who’ll help take your venture to the next aReach a larger audience with smart, creative marketing initiatives.level.

chateau4paws.com

Fayetteville, GA

Dog grooming salon

Clover Merchant Since: August 2016

If I did not have the Clover Capital, I would use my credit card, something I want to avoid,” Russell explains. “I’m in a better place because of Clover Capital, it allows me to use that cash flow to grow my business.”

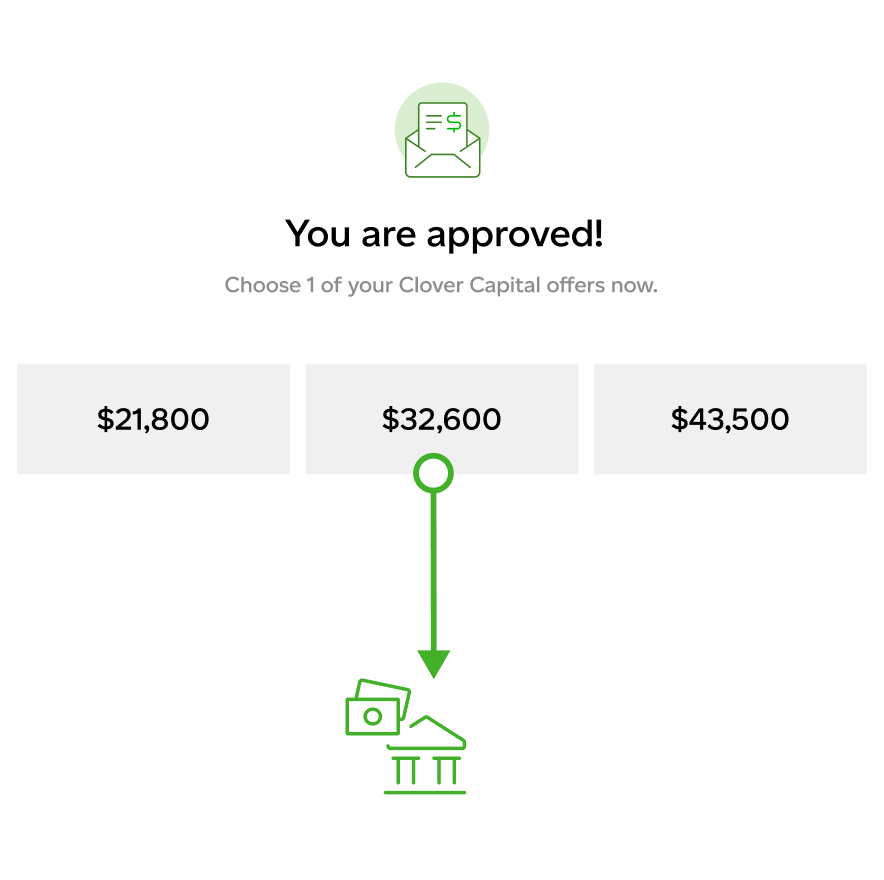

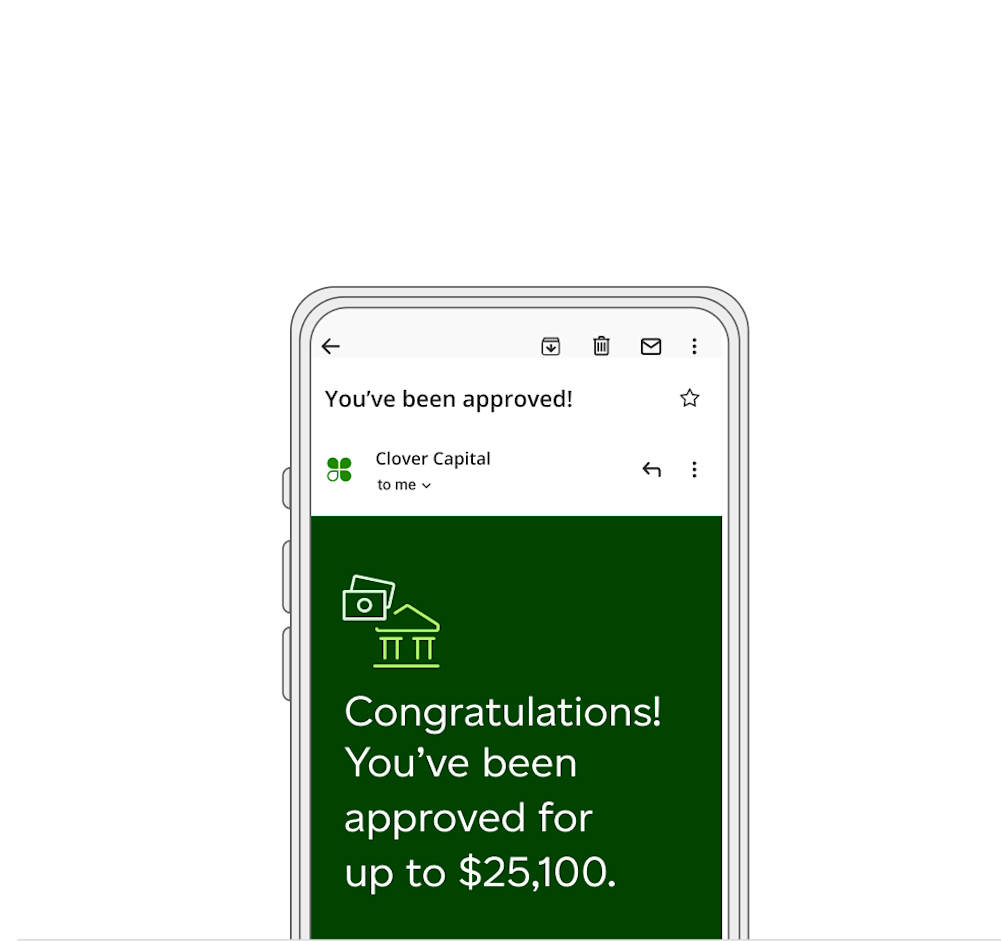

If you’re eligible, you will receive an email offer. Login into the Clover Dashboard to view the pre-filled application.

Clover Capital automatically sets aside parts of your sales so you never have to worry about a due date.

Select Clover merchants in the United States and Canada are currently eligible. If you’re eligible for Clover Capital, you will receive an email to apply for funding. When you login to the Clover Dashboard, a message will also appear inviting you to view your available funding offers.

Clover Capital is available to merchants who have been processing with Clover or its approved resellers for at least 90 days and must be in business for at least 6 months to be eligible. Eligibility is then determined by our underwriting model which will consider your business’s processing history, your personal credit, and other business attributes. You do not need to have a Clover device to be eligible for Clover Capital.

Once you are approved and have accepted your offer, funds will be deposited into your bank account via ACH in under 48 hours. For certain merchants who only recently started processing, we will wait to see processing consistent with your application before sending funds.

Applying for Clover Capital will not affect your personal or business credit score.

At the end of your subscription term, you have the option to purchase or return your equipment. If you do not choose one of these options, your subscription term will be extended at the same monthly charge.

If you don’t want to continue to rent the equipment on a month-to-month basis after your subscription ends, you’ll need to inform Clover at least 30 days before the end of the subscription term and state whether you’ll be returning or purchasing your equipment (price will be provided upon receipt of the notification).

Your payments will be taken automatically out of your daily processing. Payments are based on a percentage of your sales. You’ll pay more when your sales are strong, less if sales slow down.

It’s never been easier. Set up your Clover POS system with the right mix of devices and apps for your business. Add more devices or apps when you’re ready.